An IPO is being launched on the NSE SME platform, aiming to raise funds through a book-built issue. The offering includes up to 34.34 lakh equity shares of face value ₹10 each.

🏭 Company Overview

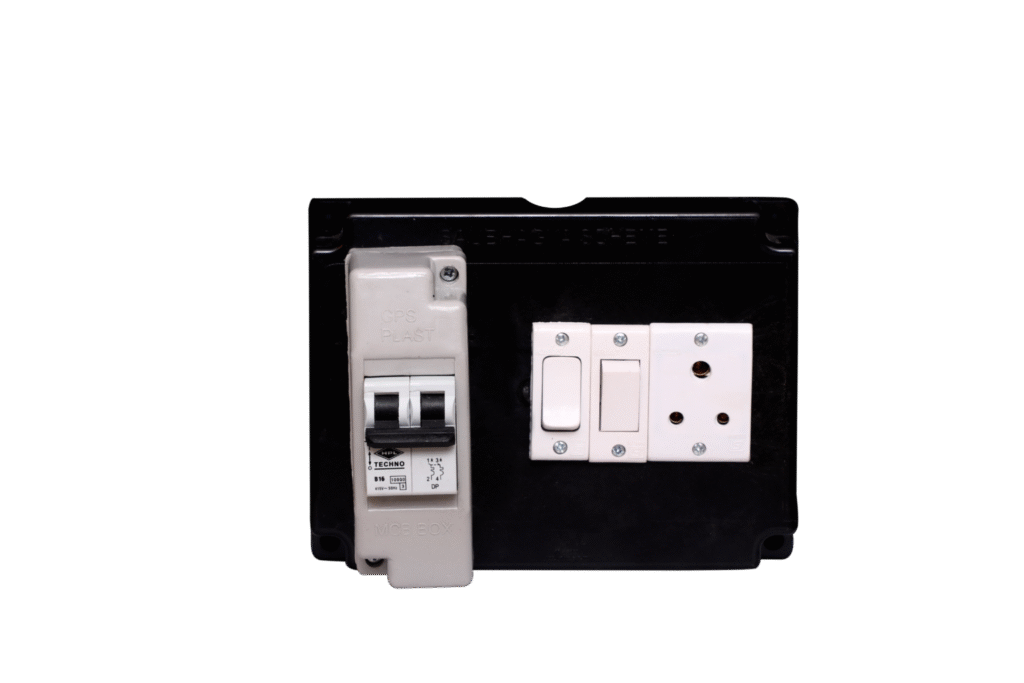

Established in 1977, the company operates in the power electronics and metering sector. It manufactures a wide range of products including:

- Static and smart energy meters

- Water meters

- SMPS (Switched-Mode Power Supply)

- UPS (Uninterruptible Power Supply)

- AVR (Automatic Voltage Regulators)

- MCBs, battery chargers, transducers

- LED luminaires

It owns a 36,000 sq. ft. manufacturing unit in Greater Noida equipped with SMT lines, plastic molding machines, and a NABL-accredited R&D laboratory.

Lot Size & Investment Details

| Appy as | Price Band | Lot Size | Share | Appy Upto |

| Retail (Min) | ₹125 – ₹128 | 1 lot | 1,000 shares | ₹1,28,000 |

| Retail (Max) | ₹125 – ₹128 | 1 lot | 1,000 shares | ₹1,28,000 (Retail limit) |

| S-HNI (Min) | ₹125 – ₹128 | 2 lot | 2,000 shares | ₹2,56,000 |

📊 Financial Highlights

| Financial Year | Revenue (₹ Cr) | EBITDA (₹ Cr) | Net Profit (₹ Cr) |

|---|

| FY 2023–24 | 80.04 | 8.43 |

🎯 Objects of the Issue

The IPO proceeds will be used for:

- Working Capital Requirements

- Capital Expenditure – Procurement and installation of new machinery

- General Corporate Purposes

📈 IPO Review & Recommendation

✅ Strengths

- Over four decades of industry presence

- In-house R&D and certified quality processes

- Diversified product range covering critical infrastructure needs

- Trusted supplier to multiple government utilities

⚠️ Risks

- Volatility typical to SME IPOs post-listing

- High dependency on public sector demand

- Execution risk in deploying raised capital efficiently

📊 Recommendation

A strong contender in the infrastructure and energy tech space, the IPO reflects a stable business model backed by certifications and a wide product range. It may suit medium to long-term investors seeking exposure to power and smart metering sectors, though attention should be given to post-listing liquidity and execution capability.